![]() After two strong years, the sensor and actuator market has cooled off as a result of inventory drawdowns, slowing unit shipments, and economic uncertainty, says report.

After two strong years, the sensor and actuator market has cooled off as a result of inventory drawdowns, slowing unit shipments, and economic uncertainty, says report.

Inventory corrections, slowing smartphone shipments, and pullbacks in purchase orders throttled sales growth in semiconductor sensors and actuators last year, resulting in a subpar 6% increase in 2018 to a record-high $14.7 billion after double-digit percentage gains in 2017 and 2016, according to IC Insights’ 2019 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes.

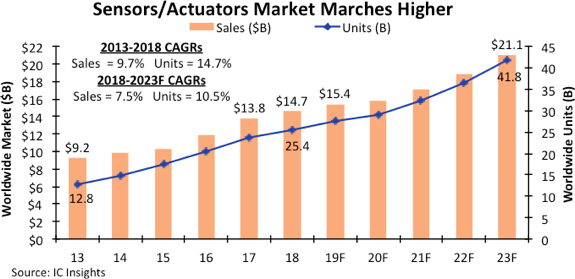

The downtrend in sensor/actuator growth carried into the first quarter this year with worldwide sales rising by just 2% compared to the same three-month period in 2018, but this semiconductor market segment is expected to reclaim some strength in the next six months and increase 5% in 2019 to a new record-high $15.4 billion, says the 350-page O-S-D Report. After slowing to 3% growth in 2020 because of global economic weakness, sensor/actuator sales are expected to gradually regain stronger momentum between 2021 and 2023 to reach $21.1 billion in the next four years (Figure 1).

The 2019 O-S-D Report shows that total sensor sales grew 8% in 2018 to a record-high $9.1 billion after rising 15% in 2017 and 14% in 2016. Actuator revenues increased 4% last year to an all-time high of $5.5 billion, following strong increases of 18% in 2017 and 19% in 2016. Worldwide sales of sensors and actuators are both projected to grow about 5% in 2019 to reach $9.6 billion and $5.8 billion this year, respectively, according to the O-S-D Report’s forecast. Non-optical sensors and actuators are placed in the same market category by the World Semiconductor Trade Statistics (WSTS) organization because these devices are transducers, converting one form of energy into another. (Image and light sensors are in WSTS’s optoelectronics market category and not counted in the sensor/actuator numbers.)

About 83% of sensor and actuator sales in 2018 ($12.2 billion) came from semiconductors built with microelectromechanical systems (MEMS) technology. MEMS is used in pressure sensors (including microphone chips), accelerometers, gyroscope devices, and nearly all actuators. MEMS-based sensors and actuator sales grew 6% in 2018 after climbing 18% in 2017 and 15% in 2016, says the 2019 O-S-D Report. MEMS-based sensor/actuator sales are forecast to grow about 5% in 2019 to a record-high $12.8 billion, followed by a 3% increase in economically weak 2020, according IC Insights’ report.

Sales growth among the three main sensor categories was led by pressure sensors (including MEMS microphone chips) with a 13% increase in 2018 to $3.3 billion, followed by acceleration/yaw sensors (accelerometers and gyroscope devices) with a 4% rise to $3.4 billion, and magnetic-field sensors (including electronic compass chips) with a 4.0% gain to $2.0 billion last year, says the O-S-D Report.

Report Details: The 2019 O-S-D Report

In a one-of-a-kind study, IC Insights continues to expand its coverage of the semiconductor industry with detailed analysis of trends and growth rates in the optoelectronics, sensors/actuators, and discretes market segments in its newly revised 350-page O-S-D Report—A Market Analysis and Forecast for the Optoelectronics, Sensors/Actuators, and Discretes.

Now in its 14th annual edition, the 2019 O-S-D Report contains a detailed forecast of sales, unit shipments, and selling prices for more than 30 individual product types and categories through 2023. Also included is a review of technology trends for each of the segments. The 2019 O-S-D Report, with more than 240 charts and figures, is attractively priced at $4,190 for an individual-user license and $7,290 for a multi-user corporate license.

To review additional information about IC Insights’ new and existing market research reports and services please visit our website: www.icinsights.com.